The Federal Housing Finance Agency (FHFA) publishes a quarterly report called the House Price Index Quarterly Report. This report provides data for housing appreciation on a state by state and city-by-city basis. The report presents hard data and goes beyond the anecdotal information reported in the media. The highlights of this report for the first quarter of 2025 are:

Housing prices increased in 49 states from the first quarter of 2024 through the first quarter of 2025, with the following states showing the highest annual appreciation (Rhode Island 11.4%, West Virginia 9.3%, Connecticut 9%, Ohio 7.6% and Wyoming 8.25%).

The following chart shows the appreciation by state over the past four year through March 31, 2025:

The Housing Price Index provides price appreciation data for the past quarter, the past year and the past five-year period. The report also reports appreciation data from the first quarter of 1991 through the first quarter of 2025.

In the last 5 years the states with the highest appreciation are:

The states with the highest appreciation since 1991 are:

For Colorado, price appreciation was 1.93% for the past four quarters. For the past five years appreciation in Colorado was 43.16%. Since 1991 the appreciation in Colorado has been 597.47%, which is the third highest of any state in the country.

For the Denver Metro area, appreciation for the past year was 1.69%, for the past 5 years was 40.13%. Since 1991 the appreciation in the Denver Metro area has been 640%, which is the second highest among the largest 100 metropolitan areas in the country. Overall, housing prices rose in 89 of the largest 100 metropolitan areas over the past year.

There is a wealth of information in the report. For the full report CLICK HERE

Since mid-2022 buying a house has become significantly more expensive due to higher prices and higher interest rates. However, owning real estate remains the best, and for many, the only way for the average American to build substantial wealth.

Real estate builds wealth because of the following factors:

The Federal Reserve Bank publishes a report called Changes in U.S. Family Finances. The last report was published in October 2023 and covered the period from 2019-2022. This report tells a remarkable story about real estate ownership in the U.S.:

Average Net Worth Median Net Worth

Homeowners $1,530,900 $396,200

Non-homeowners $ 154,900 $ 10,400

This data in this report shows the following:

WAITING TO BUY

People who can financially afford to buy a house frequently ask if it makes sense to wait for interest rates to come down before buying. While every situation is unique, I tell them that waiting could cost them hundreds of thousands of dollars depending on how long they wait. The Federal Reserve data referenced above proves this.

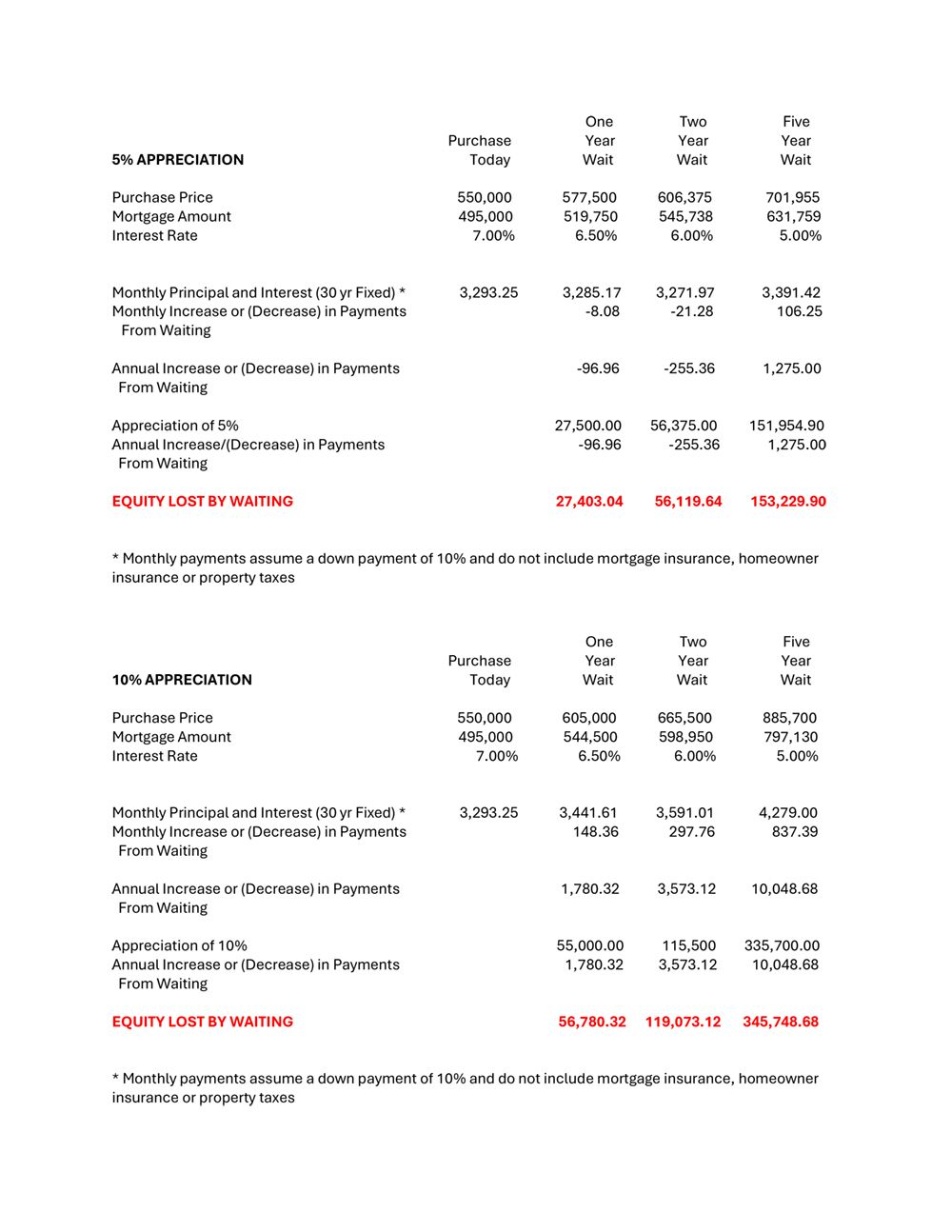

Below is an analysis showing how waiting one year, two years or five years to purchase can result in losing a substantial amount of money and wealth, if annual appreciation is 5% or 10%. Mortgage interest rates are assumed to be 7% currently, 6.5% in one year, 6% in two years, and 5% in 5 years. The charts below show the impact of waiting.

While the above analysis assumes that mortgage interest rates will decline, it is entirely possible that they stay the same or increase.

**********

Purchasing real estate is one of the most important decisions someone can make and can put them on the path to financial freedom. I recomment getting advice and help from mortgage and real estate professionals who have helped others achieve wealth through real estate. For anyone interested in how to plan and execute a strategy to buy real estate I would encourage you to call me.

The Federal Housing Finance Agency (FHFA) publishes a quarterly report entitled House Price Index Quarterly Report. This report provides appreciation data nationally, state by state and by city. The last quarterly report is for the quarter ended December 31, 2024 and provides a basis for comparison with 2023. Highlights of this report are:

The Housing Price Index provides price appreciation data for the past quarter, the past year and the past five year period. The report also reports appreciation data since the first quarter of 1991 through the 4th quarter of 2024.

In the last 5 years the states with the highest appreciation are :

The states with the highest appreciation since 1991 are:

For Colorado, price appreciation was 1.88% statewide in 2024. For the past five years appreciation in Colorado was 45.31%. Since 1991 the appreciation in Colorado has been 596.73%,which is the third highest of any state in the country. For Denver-Aurora-Lakewood, the appreciation since 1991 is 640% which is the second highest among the largest 100 metropolitan area in the country.

There is a wealth of information in the report. For the full report CLICK HERE

When approaching or reaching retirement it is common for homeowners to sell their current home to accomplish one or more of the following objectives:

OLD STRATEGY

Sell the current home and use the the proceeds from the sale to pay cash for the new home. No mortgage and no mortgage payment on the new home.

For example, the homeowner sells the current home and receives $300,000 after expenses and paying off the mortgage balance (if any). They then purchase a new home for $300,000, or less, for cash.

The old strategy has two limitations. First, the homeowner is limited on the purchase of the new home by the amount of cash they receive from the sale of the old home. Therefore, if the new home costs more than the cash they received (in the example above, $300,000) they will need to come up with additional cash or they will need to get a mortgage and make monthly mortgage payments . The homeowner may not have additional cash and may not want, or be able to afford, monthly mortgage payments. This means relocating/downsizing may not be feasible if the new property is going to cost more than the old property.

The other limitation of the old strategy is that in today’s real estate market the homeowner will most likely use all the cash proceeds which will then be tied up in the new home. Once used to purchase the house it is difficult to access this equity in the future without incurring substantial fees, a monthly mortgage payment, and the need to qualify for a mortgage or line of credit. Even if the homeowner is able to spend less than $300,000 on the new home they will still tie up more money in the new house than required in the new strategy outlined below.

NEW STRATEGY

Sell the current home for $300,000 and obtain a Home Equity Conversion Mortgage. This mortgage (sometimes referred to as a reverse mortgage) is guaranteed by the Federal Housing Authority (FHA) which is a part of the U.S. Department of Housing and Urban Development (HUD).

Option One

Purchase a new home for $300,000. Use $150,000 from the sale of the current home and get a Home Equity Conversion Mortgage of $150,000 (These numbers are an illustration. The amount available on a reverse mortgage will depend on the age of the homeowner, the value of the property and current interest rates. The amount available on a reverse mortgage generally ranges from 35% to 65% of the value of the property).

The Home Equity Conversion Mortgage does not require monthly payments for principal and interest is not required to be paid off until the homeowner moves and/or sells the property (the homeowner can make payments at any time if they choose). Under the illustration for option one the owner retains $150,000 in cash that they can use for other purposes or keep in reserve.

Option Two

Combine $300,000 cash received from the sale of the current home with a Home Equity Conversion Mortgage of $200,000 to purchase a new home for $500,000. The Home Equity Conversion Mortgage does not require monthly payments for principal and interest and is not required to be paid off until the homeowner moves and/or sells the property (the homeowner can make payments at any time if they choose).

With option two the homeowner is able to use the proceeds to acquire a more expensive house if necessary or desired without having to assume a monthly mortgage payment.

**********

The strategy outlined above allows the homeowner to more effectively utilize their equity in the following ways:

In order to be eligible to take advantage of the opportunities presented by Home Equity Conversion Mortgaes at least one of the homeowner must be 62 or older (if married) and the house must be the primary residence. The options outlined above are only one feature of a Home Equity Conversion Mortgage-there are many other benefits and planning opportunities that they can provide. Find out if they you or a family member or friend could benefit from a Home Equity Conversion Mortgage by calling Wayne Tucker at 303-468-1985 or emailing him at wtucker@spectramortgage.com

Your home equity represents the current market value of your home minus the liens (mortgages) that are attached to the property.

Home equity increases when the value of the home increases and when mortgage principal is paid to reduces the mortgage loan balance. Home equity represents savings that the homeowner has accumulated. Home equity decreases when the value of the home declines or when a homeowner takes out a loan against the property. When a homeowner uses their home equity they have made a financial decision to achieve a financial goal or objective today rather than wait to utilize it a later date (such as when they sell the property).

A homeowner can access and use their home equity when and how they choose, subject to qualification guidelines. The question of whether a homeowner should use their housing equity to meet financial or non-financial needs is an individual decision. There are good uses of home equity and there are certainly poor uses of home equity. The key point is that home equity is an asset of the homeowner (for many it is their largest asset) and can be used by the homeowner for any purpose they choose. After all, it is their money. Among the reasons people choose to use home equity are the following:

Because the interest rate on any borrowing associated with a home is lower than the interest rate on a credit card, a car loan, or other personal loans; using home equity can have significant benefits compared to utilizing any other type of borrowing. Additionally, utilizing home equity can be a more effective and tax-efficient way to access needed funds than withdrawing funds from a savings account, an investment account, or a retirement account. Lastly, a unique benefit of using home equity is that borrowing against home equity is not subject to income tax and the interest paid on any type of home equity borrowing may be tax-deductible under certain circumstances. Following are the most common strategies to access home equity:

Each of the above strategies have pros and cons and may not be appropriate in some circumstances and may not be suited to everyone. When used correctly, each strategy can provide significant benefits. For example, with a Home Equity Conversion Mortgage monthly payments are optional and there are unique features that can benefit married individuals who are over the age of 62.

There are many financial and non-financial reasons why a homeowner may want, or choose to use the equity in their home. Our role as mortgage advisors is to help our clients understand the options that are available to them. We explain the pros and cons of each option and provide the information needed to determine whether utilizing housing equity is a good financial option.

**********

We may be able to help you improve your financial position and build your wealth through proactive mortgage planning and the effective management of home equity. Contact Wayne Tucker at 303-468-1985 or at wtucker@spectramortgage.com.