Reverse Mortgages are not well understood by homeowners, financial advisors, real estate professionals or attorneys. Most do not understand that Reverse Mortgages can provide the following benefits:

The frame of reference most people have for a Reverse mortgage is from 20 years ago. Beginning in 2012 and continuing through 2020 there were major changes and revisions to Reverse mortgages and now they have become a key component in the retirement income strategy and wealth building strategy of sophisticatd homeowners and financial advisors. In addition to the financial benefits, there are significant non-financial benefits such as providing security for spouses and beneficiaries and additional options when planning for healthcare, long term care and estate planning. Unfortunately, not enough people are aware of the benefits, and worse they continue believe the myths and misinformaton that still exist.

This article will address the misinformation and myths that still exist regarding Reverse mortgages.

MYTH VS FACTS

MYTH #1 – A Reverse mortgage is a loan of last resort.

FACT: Reverse mortgages have evolved from strictly a needs-based product to a solution that many financial planners recommend as an important component of a comprehensive retirement plan and a retirement income strategy. Approximately 50% of the clients we have done a reverse mortgage for have been wealthy and view the Reverse mortgage as an investment and finanical planning tool that also offers benefits for estate planning, healthcare and long-term care planning.

MYTH #2 – When you get a Reverse mortgage you no longer own your home, the Bank owns it.

FACT: This is the number one misconception that people have. I have had homeowners, financial advisors planners and attorneys state this as a reason to not do a Reverse mortgage. The truth is the homeowner retains title and 100% ownership with a Reverse mortgage.

MYTH #3 – The bank takes your home when you pass away.

FACT: When a homeowner passes away, their ownership interest goes into their estate or is transferred to the joint tenant the same as if there were not a Reverse mortgage on the property.

MYTH #4 – My kids or other beneficiaries will be on the hook for a big liability.

FACT: Borrowers can leave their home to their kids or other beneficiaries. When the borrowers pass away, the beneficiaries may either pay the balance due on the Reverse mortgage and keep the home or they may sell the home and use the proceeds to pay off the reverse mortgage. They will never pay more than the house is worth. If they sell the home, any remaining equity after the Reverse mortgage is repaid is theirs to keep. This is no different than what happens with a property that has a regular mortgage.

MYTH #5 – The bank can foreclose if you owe more than the house is worth.

FACT: The way reverse mortgages are structured today this is highly unlikely, However, the only requirements to remain in the home are that the property taxes and insurance are paid, the HOA dues (if applicable) are current, the house is reasonably maintained, and that the last surviving borrower or an eligible spouse does not vacate the house for more than 12 consecutive months. Even if you owe more than the house is worth, the bank CANNOT foreclose if you continue to meet these requirements.

MYTH #6 – My spouse can be forced to move out of the home if I die.

FACT: Borrowing spouses and eligible spouses can remain in the home after the co-borrower or the primary borrower passes away. The spouse only needs to continue to meet the conditions of the loan (see Myth 5 above). In many ways this provides more protection than a regular mortgage. This factor is one of the prime non-financial benefits of a Reverse mortgage.

MYTH #7 – I cannot ever sell my house if I have a reserve mortgage.

FACT: While a Reverse mortgage is better suited for people who don’t plan to sell anytime soon, if circumstances change and you do need to sell, you can. You simply sell the home, pay off the balance with the proceeds of the sale, and the remaining equity is yours to keep. No different than any other mortgage. Also, a Reverse mortgage does not have a prepayment penalty.

MYTH #8 – Social Security and Medicare will be affected.

FACT: A Reverse mortgage will not have any effect on your Social Security payments or Medicare benefits. However, there could be an impact on Medicaid or other public assistance programs that are means tested. Talk to your adviser to make sure you fully understand the impact if you have means tested benefits.

MYTH #9 – I will have to pay taxes on the money I get from a Reverse mortgage.

FACT: The proceeds from a Reverse mortgage, whether paid in a lump sum or periodically, are not subject to income tax. Consult a tax advisor for more information.

MYTH #10 – Reverse mortgages are extremely costly.

FACT: This is subjective since the fees will vary depending on the type of Reverse mortgage selected and the strategies that are being pursued. In some cases, the costs will be higher than a traditional mortgage but it should be remembered that the benefits are much more significant than a traditional mortgage as well. A cost benefit analysis can only be analyzed once there is an understanding of each individuals unique goals and how a reverse mortgage can be utilzed to meet these goals. In most cases, the borrower includes the costs associated with the reverse mortgage in the initial loan amount and will not have any out-of-pocket costs.

MYTH #11 – Reverse mortgage interest rates are higher.

FACT: The majority of Reverse mortgages closed are guaranteed by the Federal Housing Authority (FHA). FHA interest rates on a Reverse mortgage are comparable to traditional mortgage rates.

MYTH # 12 – Reverse mortgages have hidden risks that can cost you your home.

FACT: This is a catchall myth. The terms of a Reverse mortgage are very clear. A borrower must pay their property taxes, homeowner’s insurance, keep the property in good repair and must maintain the property as their primary residence. These obligations are not hidden. In fact, for anyone carrying a regular mortgage, with monthly mortgage payments in retirement, I would argue that a regular mortgage carries substantially more risk of losing the house than a Reverse mortgage.

The last myth to discuss deserves its own section because in some ways it is the least understood part of a Reverse mortgage but may be the most significant benefit. Often people hear or believe the following.

MYTH #13 – A Reverse mortgage will use up all my equity and reduce the amount available for inter-generational wealth transfers to my kids, grandkids or other beneficiaries.

FACT: The common belief is that a Reverse mortgage reduces equity, thereby reducing the value of the estate for the homeowner’s heirs and this is presented as a negative. Current research and thinking on Reverse mortgages show this is not necessarily the case:

The desire to preserve home equity is often a psychological constraint that people impose on themselves which can lead to a less efficient retirement. Under the concept of retirement income efficiency, home equity and other financial assets are equivalent, and they should be looked at in total rather than in isolation. While taking money from the Reverse mortgage may reduce the home-equity component, it does not necessarily reduce the overall net worth or value of the total assets since other financial assets can grow rather than be drawn down.

Retirement-income efficiency is defined as: using assets in a way that allows for more spending and/or more wealth over time.

***************

If you are interested in finding out about the benefits a Reverse mortgage can offer contact Wayne Tucker at 303-468-1985 or at wtucker@spectramortgage.com.

The Federal Housing Finance Agency (FHFA) publishes a quarterly report called the House Price Index Quarterly Report. This report provides data for housing appreciation on a state by state and city-by-city basis. The report presents hard data and goes beyond the anecdotal information reported in the media. The highlights of this report for the first quarter of 2025 are:

Housing prices increased in 49 states from the first quarter of 2024 through the first quarter of 2025, with the following states showing the highest annual appreciation (Rhode Island 11.4%, West Virginia 9.3%, Connecticut 9%, Ohio 7.6% and Wyoming 8.25%).

The following chart shows the appreciation by state over the past four year through March 31, 2025:

The Housing Price Index provides price appreciation data for the past quarter, the past year and the past five-year period. The report also reports appreciation data from the first quarter of 1991 through the first quarter of 2025.

In the last 5 years the states with the highest appreciation are:

The states with the highest appreciation since 1991 are:

For Colorado, price appreciation was 1.93% for the past four quarters. For the past five years appreciation in Colorado was 43.16%. Since 1991 the appreciation in Colorado has been 597.47%, which is the third highest of any state in the country.

For the Denver Metro area, appreciation for the past year was 1.69%, for the past 5 years was 40.13%. Since 1991 the appreciation in the Denver Metro area has been 640%, which is the second highest among the largest 100 metropolitan areas in the country. Overall, housing prices rose in 89 of the largest 100 metropolitan areas over the past year.

There is a wealth of information in the report. For the full report CLICK HERE

The required down payment to obtain a mortgage will depend on the type of mortgage being obtained. While there are many different types of mortgages, there are 3 types that dominate the market for mortgagtes under one million. For these three categories of mortgages the minimum down payment are as follows:

A major challenge for today’s homebuyer is saving enough money for the down payment and closing costs. In addition to the mortgage programs mentioned above, there are programs that provide down payment assistance with as little as 0% down payment in certain situations. Down payment assistance programs will generally have higher interest rates and will have specific qualification criteria depending on the program and the location of the property. While it is possible to obtain a mortgage with a zero-down payment, or low-down payment, for many it is advisable to have a down payment of at least 3% in order to obtian a lower interest rate and more affordable monthly payments.

GIFT FUNDS

One option available to home buyers is to receive a gift for the down payment from an eligible donor. VA, FHA and Conventional mortgages have specific requirements for what constitutes a gift, what the gift funds can be used for, who can contribute a gift and what is involved in documenting gift funds.

Under mortgage guidelines, a gift is money given to a borrower by a family member or other eligible donor to help with their down payment or closing costs. These funds are not a loan that must be repaid. Gift funds fall into 3 main categories:

Depending on the mortgage program, eligible donors include

Generally, gift funds are allowed for mortgages that involve a primary residence or a second home but are not allowed for an investment property transaction.

To document a gift, a gift letter is required that must:

RETIREMENT ACCOUNTS

Some people choose to withdraw/borrow funds from their 401k, IRA or certain other retirement accounts. In certain cases these funds can be used withoug incurring a tax liability or a penalty. The use of retirment accounts, and the impact of mortgage and tax rules regarding the use of retirmeent funds take careful planning in consultaiton with mortgage and tax professionals.

**********

For additional information on how to take advantage of the gift rules contact Wayne Tucker at 303-468-1985 or at wtucker@spectramortgage.com.

Since mid-2022 buying a house has become significantly more expensive due to higher prices and higher interest rates. However, owning real estate remains the best, and for many, the only way for the average American to build substantial wealth.

Real estate builds wealth because of the following factors:

The Federal Reserve Bank publishes a report called Changes in U.S. Family Finances. The last report was published in October 2023 and covered the period from 2019-2022. This report tells a remarkable story about real estate ownership in the U.S.:

Average Net Worth Median Net Worth

Homeowners $1,530,900 $396,200

Non-homeowners $ 154,900 $ 10,400

This data in this report shows the following:

WAITING TO BUY

People who can financially afford to buy a house frequently ask if it makes sense to wait for interest rates to come down before buying. While every situation is unique, I tell them that waiting could cost them hundreds of thousands of dollars depending on how long they wait. The Federal Reserve data referenced above proves this.

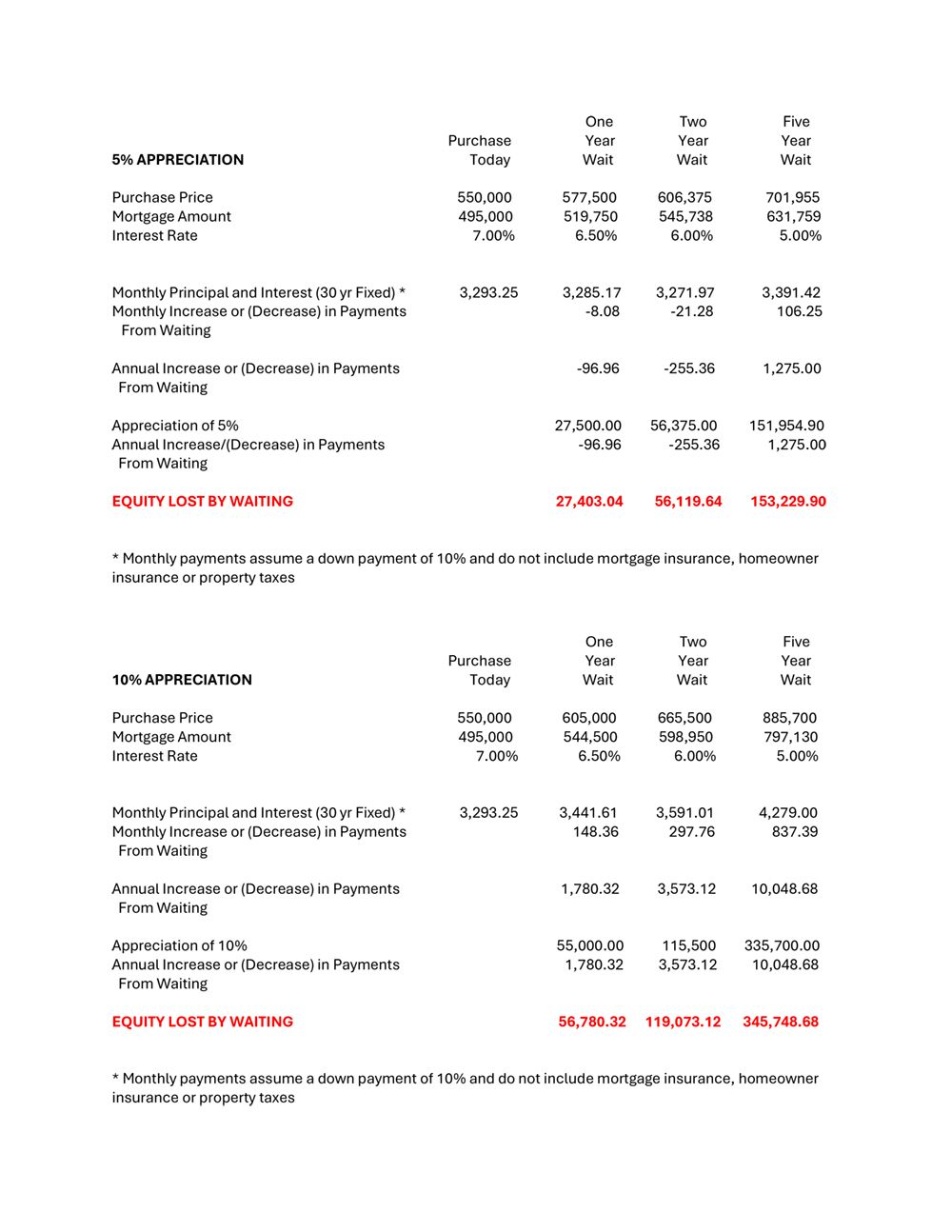

Below is an analysis showing how waiting one year, two years or five years to purchase can result in losing a substantial amount of money and wealth, if annual appreciation is 5% or 10%. Mortgage interest rates are assumed to be 7% currently, 6.5% in one year, 6% in two years, and 5% in 5 years. The charts below show the impact of waiting.

While the above analysis assumes that mortgage interest rates will decline, it is entirely possible that they stay the same or increase.

**********

Purchasing real estate is one of the most important decisions someone can make and can put them on the path to financial freedom. I recomment getting advice and help from mortgage and real estate professionals who have helped others achieve wealth through real estate. For anyone interested in how to plan and execute a strategy to buy real estate I would encourage you to call me.

The Federal Housing Finance Agency (FHFA) publishes a quarterly report entitled House Price Index Quarterly Report. This report provides appreciation data nationally, state by state and by city. The last quarterly report is for the quarter ended December 31, 2024 and provides a basis for comparison with 2023. Highlights of this report are:

The Housing Price Index provides price appreciation data for the past quarter, the past year and the past five year period. The report also reports appreciation data since the first quarter of 1991 through the 4th quarter of 2024.

In the last 5 years the states with the highest appreciation are :

The states with the highest appreciation since 1991 are:

For Colorado, price appreciation was 1.88% statewide in 2024. For the past five years appreciation in Colorado was 45.31%. Since 1991 the appreciation in Colorado has been 596.73%,which is the third highest of any state in the country. For Denver-Aurora-Lakewood, the appreciation since 1991 is 640% which is the second highest among the largest 100 metropolitan area in the country.

There is a wealth of information in the report. For the full report CLICK HERE

“It ain’t what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so”

–attributed to Mark Twain

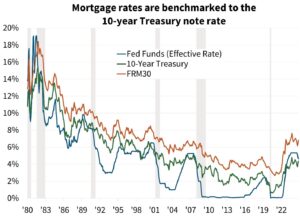

Many believe that the Federal Reserve sets mortgage interest rates. This is not true. Periodically it is good to remind everyone how mortgage interest rates are set. Here goes.

HOW ARE MORTGAGE RATES DETERMINED?

The interest rate controlled by the Federal Reserve is the federal funds rate which is the interest rate for overnight lending between banks. The federal funds rate is the interest rate used for very short-term lending. Interest rates on other short-term bonds and loans (like interest rates on credit cards) move very closely with changes in the federal funds rate.

The 15-year, 20-year and 30-year mortgage are long-duration loans, and thus have a different rate at which market participants are willing to lend versus a short-term loan, such as the federal funds rate. Mortgage rates are primarily benchmarked to the 10-year Treasury note. Therefore, movement in the 10-year Treasury has a significantly larger and more direct impact on mortgage rates than the federal funds rate.

Data sources for chart: Freddie Mac, Federal Reserve Board, Fannie Mae

Key Points

What Determines the Rate on the 10-Year Treasury Note?

The rate on the 10-year Treasury note is determined by investors’ expectations for short-term interest rates over the 10-year duration of the bond.

Consider, as an example, an investor who is choosing between the 10-year Treasury note and a much shorter-duration 1-year Treasury bill. Instead of purchasing the 10-year Treasury note, the investor could purchase a 1-year Treasury bill and roll over their investment each year into a new 1-year Treasury bill for 10 years. The investor then would consider what they expect the rate on a 1-year Treasury bill (and other short-term rates) to be over the next 10 years to determine the interest rate they require to purchase a 10-year Treasury note. Because interest rates over a 10-year period are highly uncertain, investors take on additional risk when investing in a long-duration bond. Investors typically demand a higher interest rate, known as the term premium, on a longer-duration bond compared to a short-duration bond to compensate them for this additional risk.

Investors’ expectations for shorter-term interest rates, and thus the rate they are willing to accept on the 10-year Treasury note, are determined by their views on future monetary and fiscal policy, economic growth, and inflation.

The Mortgage Spread

The mortgage rate offered to borrowers is determined by adding a spread to the benchmark 10-year Treasury note. The mortgage spread can be broken into two major components:

To compensate for the additional risks of MBS, investors demand a higher interest rate on MBS compared to the 10-year Treasury note. From 1995 to 2005, the secondary spread averaged 1.17 percentage points and was particularly volatile. Following the Great Financial Crisis, from 2012 to 2019, the secondary spread averaged 0.71 percentage points and was more stable. In the aftermath of the COVID-19 pandemic, from January 2022 through November 2024, the secondary spread has averaged 1.4 percentage points.

Following the Great Financial Crisis, the Federal Reserve began purchasing MBS and Treasury securities, a policy known as quantitative easing, to stabilize the financial system and drive interest rates, particularly mortgage rates, lower. The Fed is a non-economic buyer, which means it is not sensitive to the rate an MBS is paying. Therefore, when the Fed purchases MBS, it replaces private investors who are sensitive to the rate on MBS, which drives the secondary spread lower.

When the Fed does not purchase MBS to offset the ongoing runoff of MBS in its portfolio, a policy known as quantitative tightening, it gradually owns a smaller share of total MBS outstanding. As a result, private investors need to purchase that additional share, and as rate-sensitive buyers, they require a higher interest rate to do so. That’s why the secondary spread is driven upward when private investors replace the Fed in the MBS market.

A Look at Mortgage Rates Since 2020

When average mortgage rates hit a record low in December 2020, it was due to a 10-year Treasury rate that was well below its historical average at 0.93% and a compressed secondary spread of 0.45%. Both can be attributed, in part, to monetary policy, as the Fed kept the federal funds rate near zero and purchased significant amounts of both MBS and Treasury securities. Additionally, the outlook for economic growth was highly uncertain, and market participants considered U.S. Treasury securities to be a “safe haven” asset amid the COVID-19 pandemic. At the time, inflation was not a concern.

When mortgage rates hit their high of 7.8% in October 2023, the rate on the 10-year Treasury note had risen to a monthly average of 4.8%. Economic growth was strong, and inflation remained elevated well above the Fed’s 2-percent target. The federal funds rate was at 5.33% and the market expected a “higher for longer” policy stance from the Fed, meaning short-term rates were likely to stay high.

Additionally, the Fed’s balance sheet run-off put upward pressure on the secondary spread, which was elevated at 1.73 percentage points, as private investors sought higher rates on MBS to absorb the additional share. The rise in mortgage rates since the end of 2020 has been due primarily to an increase in the 10-year Treasury note rate and a widening in the secondary spread.

Following the September 2024 reduction in the federal funds rate, bond market investors have digested data releases that point to a stronger economy than many had expected, and somewhat-stickier inflation than previously thought. Given these developments, along with the results of the 2024 election, bond markets have priced in less monetary policy easing over the next two years. Previously, markets had expected the federal funds rate to be pushed below 3% by the end of 2026 (or even earlier), current market pricing now expects the Fed will keep rates closer to between 3.5% and 4%. Additionally, there is increased focus on the amount of Treasury issuance over the next few years. Combined, these developments have put upward pressure on the 10-year Treasury note rate, and thus mortgage rates.

On January 7, 2025, the Consumer Finance Protection Bureau (CFPB) finalized a rule that requires the removal of $49 billion in medical bills from the credit reports of approximately 15 million Americans. The CFPB has estimated that changes required by this new rule will lead to the approval of approximately 22,000 additional mortgage applications annually and that Americans with medical debt on their credit report could see their credit scores rise by an average of 20 points.

The final rule will prohibit:

The new rule will increase privacy protections and prevent debt collectors from using the credit reporting system to coerce people to pay medical bills they may not owe or that may not be accurate.

This final rule is effective 60 days after it is published in the Federal Register, approximately March 15, 2025. Consumers can file complaints regarding their credit reports on the CFPB’s website, www.cfpb/gov/complaint.

Source: CFPB Final Rule

**********

We may be able to help you improve your financial position and build your wealth through proactive mortgage planning and the effective management of home equity. Contact Wayne Tucker at 303-468-1985 or at wtucker@spectramortgage.com.

For a retiree on a fixed income and a budget, carrying debts that require monthly payments can be difficult and create financial stress. With high interest rates, these monthly payments often do not reduce the principal owed in meaningful way.

Whether the debt consists of high-interest credit cards, automotive debt or no-interest medical debt, if your monthly payment obligations are taxing the limits of your monthly budget, a reverse mortgage may offer some breathing room by allowing the debts to be paid off and the monthly payments to be eliminated.

How A Reverse Mortgage Works

Eligibility For A Reverse Mortgage

The homeowner must be 62 years or older to qualify for a government insured Home Equity Conversion Mortgage (HECM). Age limits can vary for non-government insured reverse mortgages with the youngest age for qualification being 55.

How A Reverse Mortgage Can Help Manage Debt

The proceeds of a reverse mortgage can provide the money to pay off existing debts and eliminate the monthly payment. This can immediately improve the financial position of the homeowner and their ability to manage their retirement. Key advantages that a reverse mortgage may provide include:

Other Features Of A Reverse Mortgage

**********

We may be able to help you improve your financial position through proactive mortgage planning. For anyone interested in learning how home equity can be used to improve their financial position contact Wayne Tucker at 303-468-1985 or at wtucker@spectramortgage.com.

When approaching or reaching retirement it is common for homeowners to sell their current home to accomplish one or more of the following objectives:

OLD STRATEGY

Sell the current home and use the the proceeds from the sale to pay cash for the new home. No mortgage and no mortgage payment on the new home.

For example, the homeowner sells the current home and receives $300,000 after expenses and paying off the mortgage balance (if any). They then purchase a new home for $300,000, or less, for cash.

The old strategy has two limitations. First, the homeowner is limited on the purchase of the new home by the amount of cash they receive from the sale of the old home. Therefore, if the new home costs more than the cash they received (in the example above, $300,000) they will need to come up with additional cash or they will need to get a mortgage and make monthly mortgage payments . The homeowner may not have additional cash and may not want, or be able to afford, monthly mortgage payments. This means relocating/downsizing may not be feasible if the new property is going to cost more than the old property.

The other limitation of the old strategy is that in today’s real estate market the homeowner will most likely use all the cash proceeds which will then be tied up in the new home. Once used to purchase the house it is difficult to access this equity in the future without incurring substantial fees, a monthly mortgage payment, and the need to qualify for a mortgage or line of credit. Even if the homeowner is able to spend less than $300,000 on the new home they will still tie up more money in the new house than required in the new strategy outlined below.

NEW STRATEGY

Sell the current home for $300,000 and obtain a Home Equity Conversion Mortgage. This mortgage (sometimes referred to as a reverse mortgage) is guaranteed by the Federal Housing Authority (FHA) which is a part of the U.S. Department of Housing and Urban Development (HUD).

Option One

Purchase a new home for $300,000. Use $150,000 from the sale of the current home and get a Home Equity Conversion Mortgage of $150,000 (These numbers are an illustration. The amount available on a reverse mortgage will depend on the age of the homeowner, the value of the property and current interest rates. The amount available on a reverse mortgage generally ranges from 35% to 65% of the value of the property).

The Home Equity Conversion Mortgage does not require monthly payments for principal and interest is not required to be paid off until the homeowner moves and/or sells the property (the homeowner can make payments at any time if they choose). Under the illustration for option one the owner retains $150,000 in cash that they can use for other purposes or keep in reserve.

Option Two

Combine $300,000 cash received from the sale of the current home with a Home Equity Conversion Mortgage of $200,000 to purchase a new home for $500,000. The Home Equity Conversion Mortgage does not require monthly payments for principal and interest and is not required to be paid off until the homeowner moves and/or sells the property (the homeowner can make payments at any time if they choose).

With option two the homeowner is able to use the proceeds to acquire a more expensive house if necessary or desired without having to assume a monthly mortgage payment.

**********

The strategy outlined above allows the homeowner to more effectively utilize their equity in the following ways:

In order to be eligible to take advantage of the opportunities presented by Home Equity Conversion Mortgaes at least one of the homeowner must be 62 or older (if married) and the house must be the primary residence. The options outlined above are only one feature of a Home Equity Conversion Mortgage-there are many other benefits and planning opportunities that they can provide. Find out if they you or a family member or friend could benefit from a Home Equity Conversion Mortgage by calling Wayne Tucker at 303-468-1985 or emailing him at wtucker@spectramortgage.com

Your home equity represents the current market value of your home minus the liens (mortgages) that are attached to the property.

Home equity increases when the value of the home increases and when mortgage principal is paid to reduces the mortgage loan balance. Home equity represents savings that the homeowner has accumulated. Home equity decreases when the value of the home declines or when a homeowner takes out a loan against the property. When a homeowner uses their home equity they have made a financial decision to achieve a financial goal or objective today rather than wait to utilize it a later date (such as when they sell the property).

A homeowner can access and use their home equity when and how they choose, subject to qualification guidelines. The question of whether a homeowner should use their housing equity to meet financial or non-financial needs is an individual decision. There are good uses of home equity and there are certainly poor uses of home equity. The key point is that home equity is an asset of the homeowner (for many it is their largest asset) and can be used by the homeowner for any purpose they choose. After all, it is their money. Among the reasons people choose to use home equity are the following:

Because the interest rate on any borrowing associated with a home is lower than the interest rate on a credit card, a car loan, or other personal loans; using home equity can have significant benefits compared to utilizing any other type of borrowing. Additionally, utilizing home equity can be a more effective and tax-efficient way to access needed funds than withdrawing funds from a savings account, an investment account, or a retirement account. Lastly, a unique benefit of using home equity is that borrowing against home equity is not subject to income tax and the interest paid on any type of home equity borrowing may be tax-deductible under certain circumstances. Following are the most common strategies to access home equity:

Each of the above strategies have pros and cons and may not be appropriate in some circumstances and may not be suited to everyone. When used correctly, each strategy can provide significant benefits. For example, with a Home Equity Conversion Mortgage monthly payments are optional and there are unique features that can benefit married individuals who are over the age of 62.

There are many financial and non-financial reasons why a homeowner may want, or choose to use the equity in their home. Our role as mortgage advisors is to help our clients understand the options that are available to them. We explain the pros and cons of each option and provide the information needed to determine whether utilizing housing equity is a good financial option.

**********

We may be able to help you improve your financial position and build your wealth through proactive mortgage planning and the effective management of home equity. Contact Wayne Tucker at 303-468-1985 or at wtucker@spectramortgage.com.