Since mid-2022 buying a house has become significantly more expensive due to higher prices and higher interest rates. However, owning real estate remains the best, and for many, the only way for the average American to build substantial wealth.

Real estate builds wealth because of the following factors:

- Appreciation in value

- Equity build-up via mortgage payments

- Provides passive income

- Provides hedge against inflation

- Provides diversity away from volatile financial assets (i.e. the stock market)

- Uses leverage (debt) in a good way

- Provides housing stability, allowing an individual to focus on other financial goals

The Federal Reserve Bank publishes a report called Changes in U.S. Family Finances. The last report was published in October 2023 and covered the period from 2019-2022. This report tells a remarkable story about real estate ownership in the U.S.:

Average Net Worth Median Net Worth

Homeowners $1,530,900 $396,200

Non-homeowners $ 154,900 $ 10,400

This data in this report shows the following:

- The average net worth of homeowners is almost 10 times more than the average net worth of non-homeowners.

- The median net worth of homeowners is 38 times higher than the median net worth of non-homeowners.

WAITING TO BUY

People who can financially afford to buy a house frequently ask if it makes sense to wait for interest rates to come down before buying. While every situation is unique, I tell them that waiting could cost them hundreds of thousands of dollars depending on how long they wait. The Federal Reserve data referenced above proves this.

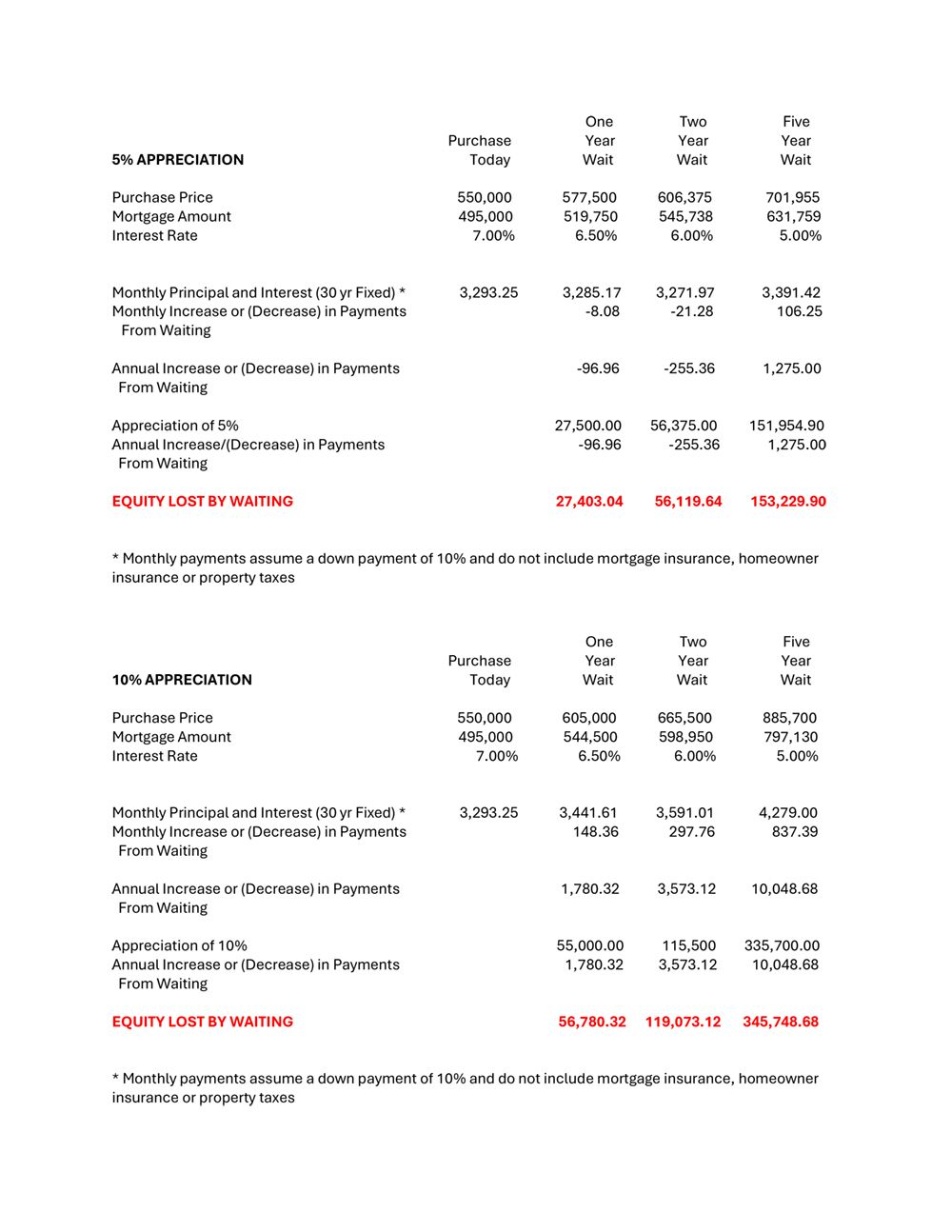

Below is an analysis showing how waiting one year, two years or five years to purchase can result in losing a substantial amount of money and wealth, if annual appreciation is 5% or 10%. Mortgage interest rates are assumed to be 7% currently, 6.5% in one year, 6% in two years, and 5% in 5 years. The charts below show the impact of waiting.

While the above analysis assumes that mortgage interest rates will decline, it is entirely possible that they stay the same or increase.

**********

Purchasing real estate is one of the most important decisions someone can make and can put them on the path to financial freedom. I recomment getting advice and help from mortgage and real estate professionals who have helped others achieve wealth through real estate. For anyone interested in how to plan and execute a strategy to buy real estate I would encourage you to call me.