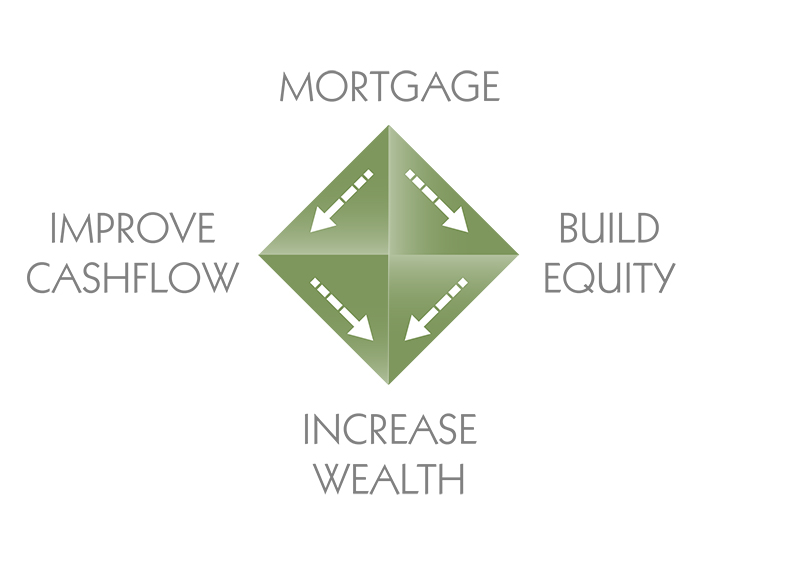

Your Mortgage Should Work For You

The right mortgage will improve your cash flow, build your equity, and contribute to your increased wealth.

Let Spectra Mortgage show you how.

The right mortgage will improve your cash flow, build your equity, and contribute to your increased wealth.

Let Spectra Mortgage show you how.

The right mortgage will improve your cash flow, build your equity, and contribute to your increased wealth.

Let Spectra Mortgage show you how.

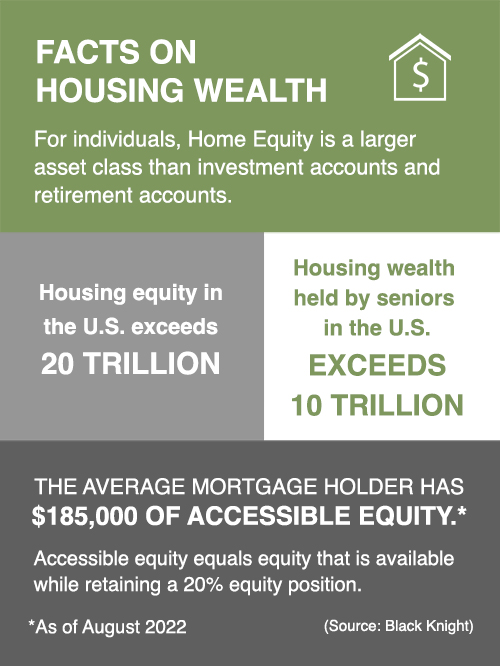

For most homeowners, equity in real estate is their largest asset and their greatest source of wealth. Unfortunately, most people and financial planners ignore the largest asset when doing financial planning and retirement planning.

Home equity supports:

Learn more about how planning and choosing the right mortgage can build your equity and help build your wealth.

Contact us to find out how your mortgage can work for you.

Please note that this is just an estimate based on your address and may not reflect the actual value of your home.

Spectra Mortgage Corporation

3900 South Wadsworth Boulevard

Suite 415

Lakewood, CO 80235

Ph: 303-468-1985

YOUR MORTGAGE SHOULD WORK FOR YOU